Stocks Basics for the Pinoy Investors summarized. Lets get started!

What is a Stock?

A stock (also known as “shares” and “equity) is a type of security that signifies ownership in a corporation and represents a claim on part of the corporation’s assets and earnings. Stocks are bought and sold predominantly on stock exchanges through stockbrokers.

Stocks are classified according to types and classes, depending on the characteristics and earnings potential.

A holder of stock (a shareholder) has a claim to a part of the corporation’s assets and earnings. In other words, a shareholder is an owner of a company. Ownership is determined by the number of shares a person owns relative to the number of outstanding shares. For example, if a company has 1,000 shares of stock outstanding and one person owns 100 shares, that person would own and have a claim to 10% of the company’s assets.

Stocks are the foundation of nearly every portfolio. Historically, they have outperformed most other investments over the long run.

How to Make Money in Stocks?

Capital Appreciation. is the increase in the value of an investment over time. It is the difference between the price at which a stock is sold and the purchase price of the stock.

For example, if you buy a share of stock at Php100.00, and it rises to Php110.00, your capital appreciation or gain is Php10.00. Keep in mind that you only realize your gain of Php10.00 minus applicable charges, if you sell at Php110.00. If you choose to hold it and it further increases to Php150.00, your capital gain would be Php50.00. However, if your stock decreases to Php100.00, and you decide to sell it at that price, then your capital gain is zero.

Dividends. are paid out to shareholders, representing earnings of the company that are not going to be reinvested in their business. There are two types of dividends: cash and stock dividends.

A cash dividend represents earnings declared by the company for every share of stock. So, if the company declares a dividend of 25 centavos per share, a stockholder with 10,000 shares will receive a cash dividend of (Php2,500.00 minus tax of 10% for individual Filipino investors)(Php0.25 x 10,000) in cash.

Stock dividends are additional shares given to shareholders at no cost. If the company declares a 25 percent stock dividend, a stockholder with 10,000 shares will be entitled to an additional 2,500 shares of stock. These shares can be sold anytime after the shares have been issued.

Stocks according to Rights

a. Common stock – It is a security usually purchased for participation in the profits and control of ownership and management of the company. A common stockholder exercises control through voting rights during annual or special stockholders’ meetings, but can only claim rights to the company’s assets and earnings when preferred shareholders are already paid in full.

Most of the issues traded in the local stock market are common stocks. Common stocks are also known as “ordinary shares.”

b. Preferred stock – It is a security whereby the holder has a higher claim on the assets and earnings of the company.

In terms of dividend payment and liquidation, preferred shareholders have priority over common shareholders. Though preferred stockholders do not have voting rights, they are entitled to receive dividends before any dividends are paid to the common stockholders.

Preferred stocks usually have a specified limited rate of return or dividend and a specified limited redemption and liquidation price.

Preferred stocks are also known as “preference shares.”

Common stock usually entitles the owner to vote at shareholders’ meetings and to receive dividends. Preferred stockholders generally do not have voting rights, though they have a higher claim on assets and earnings than the common stockholders. For example, owners of preferred stock receive dividends before common shareholders and have priority in the event that a company goes bankrupt and is liquidated.

Stocks according to Investment Characteristics

Common and preferred stocks may fall into one or more of the following categories:

Blue-Chip Stocks are shares in large, well-known companies with a solid history of growth. They generally financially sound companies that have demonstrated their ability to pay dividends in both good and bad times. They also exhibit more modest but dependable returns and are relative to lower risk.

Growth Stocks have earnings growing at a faster rate than the market average. They rarely pay dividends and investors’ earnings are reinvested in capital projects, investors buy them in the hope of capital appreciation. A start-up technology company is likely to be a growth stock.

Income Stocks pay dividends consistently due to steady profits. Investors buy them for the income they generate. An established utility company is likely to be an income stock. Since they are stable, income stocks generally have a lower level of volatility.

Value stocks have a low price-to-earnings (PE) ratio, meaning they are cheaper to buy than stocks with a higher PE. Value stocks may be growth or income stocks, and their low PE ratio may reflect the fact that they have fallen out of favor with investors for some reason. People buy value stocks in the hope that the market has overreacted and that the stock’s price will rebound.

Defensive stocks – are shares that provide regular dividends and stable earnings, regardless of the overall condition of the stock market. Defensive stocks remain stable under difficult economic conditions. Generally, these are stocks of food, oil, and utility companies, which are characterized by steady demand amidst hard times.

Cyclical stocks – are those sensitive to business conditions or cycles strongly tied with the economy’s performance. These companies produce or offer services that are low in demand during slowdown and increase when business peaks.

Speculative stocks – are those that rise quickly when economic growth is strong and falls rapidly when growth is slowing down. A speculative stock is considered very risky because of its volatility. It increases or decreases rapidly depending on the economic conditions.

Another way to categorize stocks is by the size of the company, as shown in its market capitalization. There are large-cap, mid-cap, and small-cap stocks. Shares in very small companies are sometimes called “microcap” stocks. The very lowest priced stocks are known as “penny stocks.” These companies may have little or no earnings. Penny stocks do not pay dividends and are highly speculative.

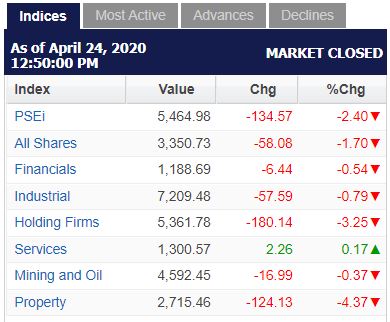

Stocks according to Sector

Stocks listed and traded on the PSE are classified into six (6) sectors:

1. Financials Sector – includes companies engaged in banking, investments, and finance.

2. Industrial Sector – includes companies involved in the following:

a. Electricity, Energy, Power, and Water

b. Food, Beverage, and Tobacco

c. Construction, Infrastructure, and Allied Services

d. Chemicals

e. Diversified Industrials

3. Holding Firms Sector – includes companies or firms that control or manage partial or complete interest in another company or other companies. Usually, these companies do not produce goods or services itself; rather, its purpose is to own shares of other companies.

4. Property Sector – includes companies involved in land and property development

5. Services Sector – includes companies involved in the following:

a. Media

b. Telecommunications

c. Information Technology

d. Transportation Services

e. Hotel and Leisure

f. Education

g. Diversified Services

6. Mining and Oil Sector – includes companies engaged in mineral extraction, oil exploration, extraction and production

What is a Stock Exchange?

A stock exchange, securities exchange or bourse, is a facility where stock brokers and traders can buy and sell securities, such as shares of stock and bonds and other financial instruments. Stock exchanges may also provide for facilities the issue and redemption of such securities and instruments and capital events including the payment of income and dividends. Securities traded on a stock exchange include stock issued by listed companies, unit trusts, derivatives, pooled investment products, and bonds. Stock exchanges often function as “continuous auction” markets with buyers and sellers consummating transactions at a central location such as the floor of the exchange. Many stock exchanges today use electronic trading, in place of the traditional floor trading.

There is usually no obligation for stock to be issued through the stock exchange itself, nor must stock be subsequently traded on an exchange. Such trading may be off exchange or over-the-counter. This is the usual way that derivatives and bonds are traded. Increasingly, stock exchanges are part of a global securities market. Stock exchanges also serve an economic function in providing liquidity to shareholders in providing an efficient means of disposing of shares. The Philippine Stock Exchange (PSE) is the stock exchange of the Republic of the Philippines.

The home of the Philippines Stock Market is at Bonifacio Global City Taguig (BGC), 5th Avenue corner 28th Street, where the main office of PSE and Stock Brokerage Firms are located.

The PSE used to operate at PSE Center(Tektite Bldg) in Ortigas Pasig City and PSE Tower One at Makati City but they move all their operations to BGC last 2018.

Starting in the Stock Market can be pain full for newbie investors, that is why we made this article for you to help you start with your stock market journey! Follow this Link: How to Open an Account in the Philippine Stock Market.

How to be successful in stocks? Follow this link: Rules on Stock Market Investing.

*The owner of StockBytes PH is a licensed stock broker, contact us if you want to open an account.

Ready to start your financial journey? email us at [email protected] or follow our social media account and join our groups, Cheers!